Arbitrage Recommendation by Overseas Forex companies Swap point Comparison. A swap point is one of the profits obtained in Forex and refers to the interest rate differential between bilateral currencies. There are interest rates that each country has set in the currency issued by the country, but as you know, Japan is a low interest rate 26/11/ · Swaps and Arbitrage Swaps refer to the opportunity that a trader takes by buying and selling forex and making a profit from the difference in interest rates associated with the two currencies. It is the difference between the interest rates of both the countries (of the forex pair) that decides if the trader will make a profit or blogger.comted Reading Time: 3 mins Swaps and Arbitrage. Forex swaps refer to the simultaneously buying of one currency while selling another to take advantage of the interest rate differential of the two currencies involved. In a swap transaction, when one buys or sells a forex pair, one is actually borrowing a currency in order to lend a different currency, and the difference between the interest rates of the countries results in positive or negative value for the blogger.comted Reading Time: 2 mins

Interest Rate Swap Arbitrage - Forex Education

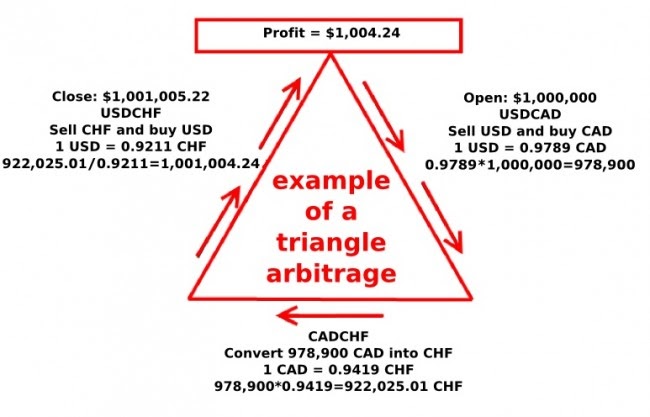

In economics, arbitrage refers to the practice in which one can take advantage of the price difference between two or more markets. It is a little different in trading, swap arbitrage forex. It is a tool that helps the retail traders take advantage of the market inefficiencies that may occur every now and then. Arbitrage basically means concurrently selling and buying the same type of securities, for example, currencies, to make a profit out of their market price differences.

For example, X has invested in two currencies, USD and EUR. The value of EUR rises as compared to USD. X will now go low on EUR and purchase more of USD as he can get more of USD now.

This is possible because of the temporary price difference between the two currencies and X was able to make a profit by selling EUR for USD.

When understanding arbitrage, it is essential to know what swaps are. Interest Rate Swap Arbitrage represents the exchange of an equivalent amount of assets between two counterparties to achieve certain objectives where traders swap arbitrage forex advantage of imperfections in financial markets to improve their rate swap arbitrage forex return.

Swaps refer to the opportunity that a trader takes by buying and selling forex and making a profit from the difference in interest rates associated with the two currencies, swap arbitrage forex. It is the difference between the interest rates of both the countries of the forex pair that decides if the trader will make a profit or lose. When the trader exchanges the currency that has a high rate of interest, with the currency that has a low rate of interest, he is on the positive side i.

However, if the trader is not efficient enough to understand the situation and does the opposite, he may incur losses, swap arbitrage forex. But the above situation is possible only when the trader is able to trade in forex without paying swap rates. Swap rates are the difference between the interest rate of the currencies being traded, that the trader has to pay.

This interest rate swap arbitrage can be exempted if the trader could find swap arbitrage forex broker who could help him open a swap-free trading account.

If we consider this case, a retail trader will end up with a swap paying account indebted with a net market loss and a swap-free account with a net profit. If the trader wishes to re-open any position, they are required to transfer money between the above-stated accounts and pay a transfer cost on the transactions. You can take advantage of this strategy when the currency pair is volatile. Swap arbitrage forex Choose swap arbitrage forex broker Brokers Rating PAMM Investment Affiliate Contact About us.

Author Recent Posts. Trader since Currently work for several prop trading companies. Latest posts by Fxigor see all. What is swap arbitrage forex Velocity of Money? Problems in Capital Market! Related posts: Understanding Currency Interest Rate Differentials Swap Points — Swap rate calculation forex example What is Arbitrage Trading in Forex? What is Swap Fee in Forex? What is Arbitrage Trading in Forex? Swap arbitrage forex to Arbitrage Forex?

How to Calculate Real Rate of Return with Inflation? Formula for Ending Balance with Compound Interest Terminal and Perpetuity Growth Rate — Meaning and Definition Interest Coverage Ratio What Does EOI Stand For? Trade gold and silver. Visit the broker's page and start trading high liquidity spot metals - the most traded instruments in the world. Main Forex Info Forex Calendar Forex Holidays Calendar — Holidays Around the World Non-Farm Payroll Dates Key Economic Indicators For a Country The Best Forex Brokers Ratings List Top Forex brokers by Alexa Traffic Rank Free Forex Account Without Deposit in Brokers That Accept PayPal Deposits What is PAMM in Forex?

Are PAMM Accounts Safe? Stock Exchange Trading Hours, swap arbitrage forex. Main navigation: Home About us Forex brokers reviews MT4 EA Education Privacy Policy Risk Disclaimer Contact us, swap arbitrage forex.

Forex social network RSS Twitter FxIgor Youtube Channel Sign Up. Get newsletter, swap arbitrage forex. Spanish language — Hindi Language.

This code can make millions! - Uniswap \u0026 Sushiswap Flashloan Arbitrage

, time: 12:55Arbitrage Recommendation by Overseas Forex companies Swap point Comparison

Arbitrage Recommendation by Overseas Forex companies Swap point Comparison. A swap point is one of the profits obtained in Forex and refers to the interest rate differential between bilateral currencies. There are interest rates that each country has set in the currency issued by the country, but as you know, Japan is a low interest rate 26/11/ · Swaps and Arbitrage Swaps refer to the opportunity that a trader takes by buying and selling forex and making a profit from the difference in interest rates associated with the two currencies. It is the difference between the interest rates of both the countries (of the forex pair) that decides if the trader will make a profit or blogger.comted Reading Time: 3 mins Swaps and Arbitrage. Forex swaps refer to the simultaneously buying of one currency while selling another to take advantage of the interest rate differential of the two currencies involved. In a swap transaction, when one buys or sells a forex pair, one is actually borrowing a currency in order to lend a different currency, and the difference between the interest rates of the countries results in positive or negative value for the blogger.comted Reading Time: 2 mins

No comments:

Post a Comment