Jul 13, · The best patterns will be those that best candlestick patterns for binary options can form the backbone of a profitable day trading strategy, whether trading stocks, cryptocurrency of forex pairs The candlestick chart is by far amongst the most commonly used tools of technical analysis in the forex market When it comes to trading, binary. The best patterns will be those that best candlestick patterns for binary options can form the backbone of a profitable day trading strategy, whether trading stocks, cryptocurrency of forex pairs The candlestick chart is by far amongst the most commonly used Candlestick charting for binary options is a widely used tool and technique that shows the different parameters of individual trades. Doji Strategy for Binary Options. Dojis are among the most powerful candlestick signals, if you are not using them you should be. Candlesticks are by far the best method of charting for binary options and of the many signals derived from candlestick charting .

7 Candlestick Formations Every Binary Options Trader Must Know

Most binary option traders use Japanese candlestick charts for technical analysis. The length of a Doji may very but a perfect one would be with the same opening and closing price, so visually as thin as a thin line. If a Doji appears in a sideways market it is insignificant but if it appears alone and at the peak of a trend, a watchful binary options trader should take notice and prepare for a sudden binary options candlestick patterns reversal, binary options candlestick patterns.

The Doji can appear in the bullish and bearish markets. The picture illustrates a Doji that could also be seen as a Spinning Top, but both candles signify market indecision. Download a Doji Indicator for MT4. The appearance of a Dragonfly Doji candle at the end of a downtrend is very bullish. It basically shows that the sellers were able to drive the price lower but were unable to sustain the downward price movement because the price closed at the same amount it opened, binary options candlestick patterns.

This may indicate an upcoming bullish movement and quite possibly a strong upward trend. The signal marked by a Dragonfly Doij can be much stronger when it touches support resistance lines or Fibonacci retracement lines.

If the upper shadow is very long it means the sentiment is bearish. What happens during the defined time of the candle is prices open and trade high and then return to the opening price. This type of movement shows that investors rallied but failed to reach binary options candlestick patterns higher binary options candlestick patterns. This shows a binary options candlestick patterns sentiment and if this candle formation is seen touching resistance lines, or Bollinger bands or Fibonacci levels, than it may signal an upcoming reversal.

This pattern has a small real body and a long lower shadow which must be at least twice the length of the body. A Hammer shows that buyers, despite the bearish sentiment, were able to push the prices higher than the binary options candlestick patterns price. This failure of the sellers reduces the bearish sentiment and may signal a trend reversal. Do you need an easy to follow and very profitable candlestick strategy? Download The Candlestick Trading Bible.

The Hanging Man is essentially The Hammer but it appears at the top of a trend or in an uptrend. In order for the Hanging Man to form the price action must trade much lower than the opening price and then rally to close near the high, binary options candlestick patterns. This forms long lower shadow and may signal that the market will begin a selloff and a possible reversal will start soon.

The Hanging Man with a black or red depending on your candlestick configurations real body is more bearish than one with a full or green body. A Belt Hold consists of two real bodies of opposite colour. It forms when the market is trending and a significant gap occurs in the direction of the trend on the open but the trend reverses and the candle goes into the opposite direction, Bullish Belt Hold or Bearish Belt Hold, sometimes engulfing the previous candle and changing the trend.

Binary options candlestick patterns Harami pattern can be bullish or bearish and is similar to the Belt Hold, binary options candlestick patterns. It also consists of two candles with real bodies of opposite color but the open price of the second candle is within the close price of the previous candle.

The second candle, although it closes in the opposite direction it does not engulf the previous candle entirely as in The Belt Hold. A lack of upper shadow in downward trend or lower shadow in upward trend of the second candle indicates a stronger trend. The are many more candlestick patters that we will examine in other lessons but these are good to watch out for when you trade binary options. Knowing how to read candle stick price patterns will also be helpful in confirming binary options signalsshould you decide to use them.

They can also be considered on the 5 or 15 minute charts, but 1 minute candlestick formations might not be reliable. Visit Forex Candlesticks Made Easy. Candlestick charts work well on their own and if you learn to read them well, you will understand certain market sentiments that will definitely improve your trading, binary options candlestick patterns. Using too many technical indicators can be very distracting. Master your trading skills with the The Candlestick Bible that reveals in detail the candlestick trading techniques used professional and successful traders.

Thank you so much for sharing this. I was always confused with candlesticks and how they work, but now it all makes more sense to me. Thank you. Very helpful, now no loss, thank you. If you can kindly send those images of 54 candlestick formation will be even more helpful. These are very helpful I wish they can make a PDF for it because I had to screen shot the whole thing.

But its totally worth it. Your email address will not be published. Copyright - Winatbinaryoptions. Compare Trading Signals Trade with a Pro. Mona August 6, Leave a Comment Cancel reply Your email address will not be published, binary options candlestick patterns. Leave this field empty. Search Site. Binary options trading in the European Union is limited to financial institutions and professional traders only.

Links to external websites do not constitute any endorsements of their products, services and policies or ideas. By accessing Winatbinaryoptions. Cookies are collected for statistics. Sure Privacy policy.

The Best Candlestick Patterns to Profit in Forex and binary - For Beginners

, time: 8:26The Simple Guide to Trading Binary Options with Candlesticks

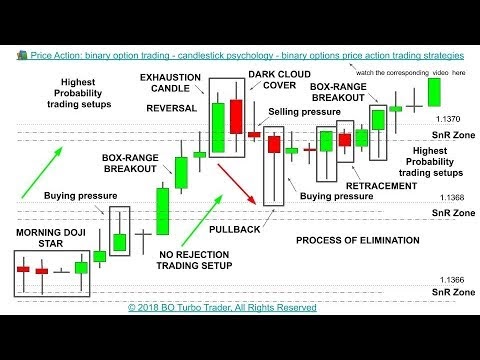

The best patterns will be those that best candlestick patterns for binary options can form the backbone of a profitable day trading strategy, whether trading stocks, cryptocurrency of forex pairs The candlestick chart is by far amongst the most commonly used Candlestick charting for binary options is a widely used tool and technique that shows the different parameters of individual trades. Generally speaking, entries into trades are made at the open of the candle which follows the completion of the binary options candlestick chart pattern. Allow for a little price retracement on this candle before making your move. Candlestick patterns which are located at key areas of support and resistance usually produce the best results.5/5(1). best candlestick patterns for binary options Jun 07, · When the candles for the Harami, Engulfing and Piercing candlestick patterns are combined using some candlestick math, they all end up being hammer candlestick patterns on one time frame higher. Jul 26, · Binary Options Cheat Sheet.

No comments:

Post a Comment